Loans To Foreigners in Costa Rica

Search Your Property

General Required Documents:

- Know Your Customer (KYC) form and Sugef form.

- Copy of Passport and Driver’s License.

- Complete Income Tax (Tax Returns) of the last 3 years.

- Value of the House or Condo.

- Credit Reports: Experian, Transunion, Equifax (At least 2).

- Only for Self-employed individuals: 6 months of personal and corporation bank statements.

- Only for Salaried employees: The last 2 months of pay stubs and 3 months of personal bank statements.

- Only for Retired individuals: Letter of pension/Security Benefits, and 3 months of personal bank statements.

- Pre-Payment Penalty (PPP): 3% on balance due before 5 years. After 5 years without PPP. Bank Commission: 1.5% of the amount to finance.

Life insurance is required: The bank provides it through an insurance company in Costa Rica.

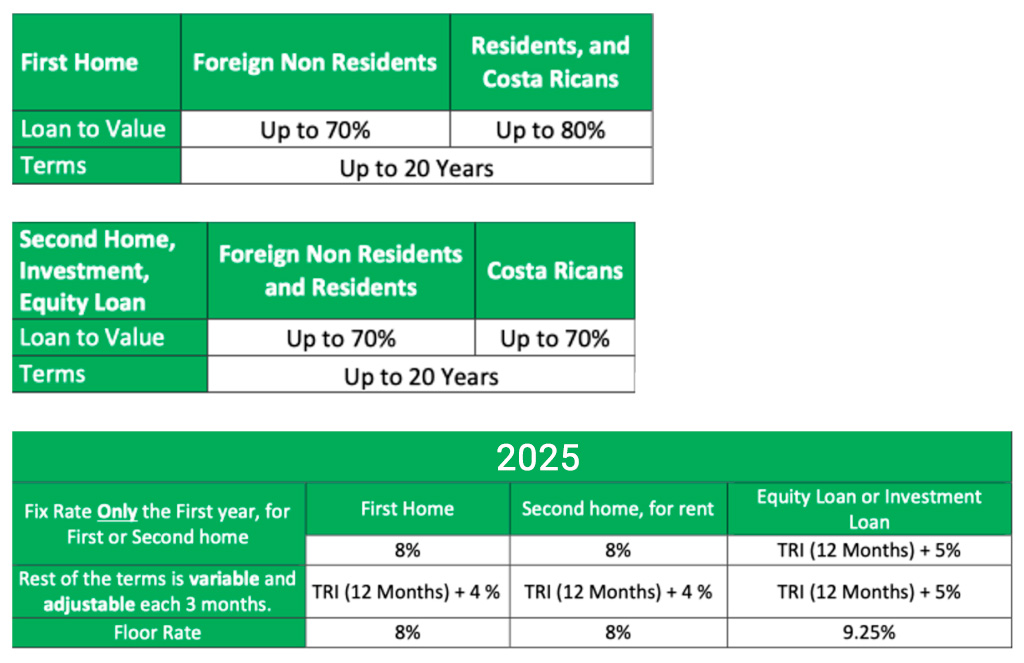

Interest Rate: It is composed of the Interbank Reference Rate called the Tri Rate, which is variable throughout the term, plus another fixed percentage to obtain the Total Interest Rate of the Loan.

Tri Rate: It is the weighted average of the certificates of deposits (CD) in Costa Rica. A CD is a savings product that earns interest on a lump sum for a fixed period of time (3 months, 6 months, 12 months). We use the Tri Rate with reference to the CD for 12 months (Tri Rate 12 months). The Tri Rate is adjustable/variable monthly. To see the fluctuations of the Tri Rate, you can click on this link: https://www.camaradebancos.fi.cr/dolares/

Conditions and terms may change without notice.